Scene 9 — 40:29

Even today, bank offices are still organized as you see in this scene. It’s just desks in a big surface occupied by bank tellers (with a vault in the back), you’re not served behind glass as you are in Europe. You can walk around freely in the bank branch; you walk up to a teller or even sit down at his desk and discuss your business with him.

Scene 9 — 40:29

The European layout of a bank branch is what F.B.I. agent Willam Rehder describes as a good situation in his book “Where the Money Is”.

The bandit barrier is a 1 ½-inch thick wall of clear, bullet-resistant Plexiglas that stretches from the top of the long teller counter to the ceiling of the bank, separating the tellers and the vault area from the customers in the lobby. Business is conducted through windows and drop slots at each teller station, and access through the bandit barrier from the lobby is only possible through locked doors at each end of the counter.

The presence of the bandit barrier in this bank, or in any bank in L.A., is actually somewhat unusual. Although similar but smaller bullet-resistant barriers are a common fixture at self-serve gas stations and rough-neighborhood liquor stores throughout Southern California, banks have traditionally resisted using them. That’s partly because they’re expensive to install, upward of $40,000, depending on the size of the bank. But mostly it’s because, in bankers’ minds, bandit barriers conflict with the warm, customer-friendly image that banking corporations spend millions of advertizing dollars trying to cultivate: welcome to our happy banking family… We’re here to serve you. But if you don’t mind, we’re going to keep our money and our suspicious-looking, potentially bank-robbing hide on opposite sides of a bullet-resistant wall. (book “Where the Money Is”, page 198-199)

(And then there’s a scam that’s only possible because you can walk around freely in a U.S. bank branch...)

Scene 8, the scene that shows Abagnale’s life as a pilot, ends with a stack of bank notes being counted. Scene 9, this scene, shows Abagnale’s visit to the Miami Mutual Bank. That doesn’t make any sense! I think the engineer who prepared the DVD master made a mistake: scene 9 starts 6 seconds too late! This insert is not in the published screenplay, it’s clearly part of the camera coverage that the director decided to shoot on the set, in the bank. Why assign it the previous scene then?

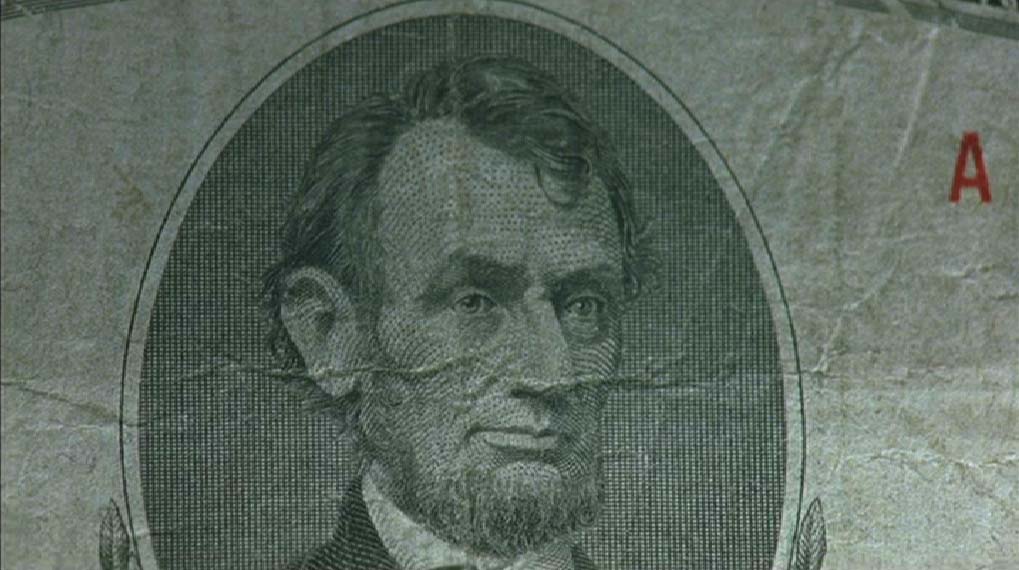

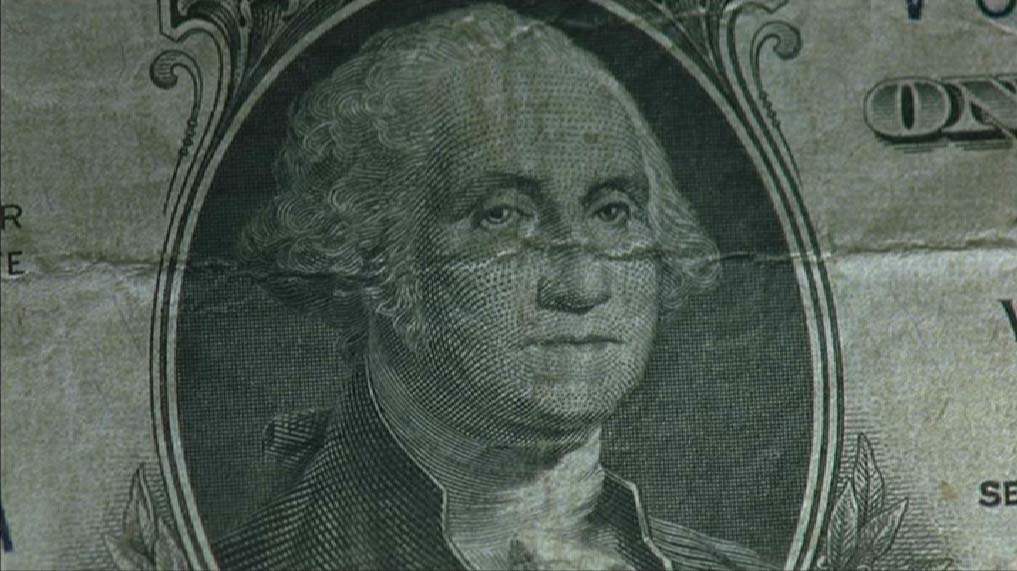

The shot works beautifully in the scene, of course, but I think there’s more to it than that. Why the extreme closeup (“ECUs” or “XCUs”) that shows the fine details of the U.S. bank notes?

Scene 8 — 39:45

I think it’s a hint. Abagnale has assisted the government in making the dollar notes safer as he has worked on the secure checks of Fortune 500 companies. Unlike the free work he does for law enforcement agencies such as the F.B.I., he has to my knowledge never stated this publically. He does say over and over that he works for “the government”. That’s broader than “the law”, it includes other government agencies than law enforcement! (His most recent book, “Scam Me If You Can”, describes how he successfully lobbied for different social security and Medicare numbers as a minimal step to thwart identity theft in the U.S. (page 98).)

But hush-hush or not, I’m pretty sure of it. Here’s why: in his book “The Art of the Steal”, he seems to know everything about the subject. He even announces new security features that weren’t in use yet at the time of writing. So, he must be in close contact with the U.S. Bureau of Engraving and Printing (“B.E.P.”)!

I say Abagnale knows if there’s microprinting hidden in the oval frame around Abraham Lincoln or a watermark visible behind George Washington’s head. Read Chapter 3 (“Counterfeit Capers”) on counterfeit money and you can’t shake the feeling that it was written by somebody in the know, who keeps the handbrake on at all times for security reasons…

Scene 8 — 39:43

Educating bank tellers about check fraud allows them to recognize fake checks. Making sales clerks aware of counterfeit money is equally noble, but there’s a thin line not be crossed: at which point does the information help the counterfeiters? With bank notes, the stakes are that much higher than with checks. Checks are part of the economy, money is the economy! Let the plague of fake money run amuck and the global economy incurs serious and long-lasting damage, no different from the current subprime mortgage crisis and its after-effects.

The movie’s end titles contain a second hint. “Since his release from prison in 1974, Frank has helped the F.B.I. capture some of the world’s most elusive check forgers and counterfeiters [...]” (scene 21, 2:09:44-2:09:52). There you have it: counterfeiters! Sure, counterfeit is not limited to money, but imitation currency is surely the most lucrative and vicious form of counterfeit…

Did you know that the U.S. Secret Service — better known for the president’s security detail, a.k.a. the suits in shades that talk to their wrists — handles these cases? (Which explains why Abagnale poses as Secret Service agent Barry Allen in the Tropicana motel to avoid arrest!)

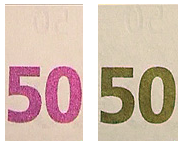

Obviously, paper money to a large extent uses the same security features as printed checks — think rosettes, vignettes, high-resolution borders etc. It also uses some unique ones that aren’t (often) used in checks such as a security thread or optically variable ink (“OVI”), ink that changes color depending on the viewing angle.

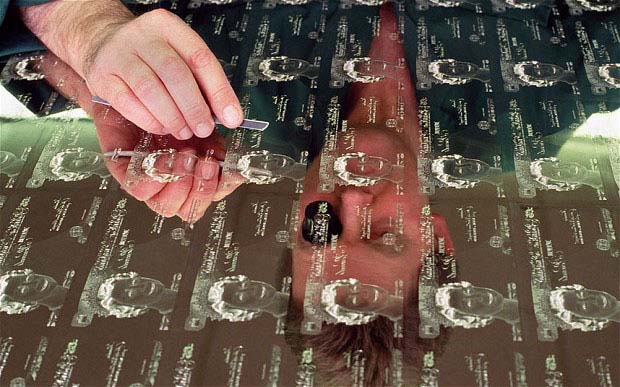

The latter techniques are not in the movie and hence not the subject of this web site, with one exception — intaglio engraving. It’s what you see in the extreme closeup and it’s what gives well printed currency (contrary to counterfeit) its distinctive look with depth, the mild “3D” effect.

First, an engraving is made on steel printing plates of the portrait, of the vignettes and of the high-resolution borders, all of them graphic elements with fine detail. (Other elements such as the Treasury Seal, Federal Rerserve seal and serial number on a bill are printed separately!)

And now intaglio printing. First, an ink with high viscosity is applied to the printing plates (step 1). The plates are wiped clean again, which leaves only the ink in the grooves (step 2). Huge pressure — as high as 15,000 psi — is applied, for instance with a roller, to transfer the ink to the paper (step 3). Because of the enormous pressure, the paper is embossed with the ink (step 4).

(step 1)

(step 2)

(step 3)

(step 4)

With intaglio printing, the ink feels somewhat raised under your fingers; other printing techniques don’t produce this effect.

Which is precisely the point of these techniques! Scanning and copying bank notes degrades the image quality noticeably! Scan a bank note with an image scanner, for instance, and the fine details of the engraving becomes muddy, dull…

Scene 9 shows the American font E13B and a MICR printer. More, much more about the font soon, let’s discuss the printer first.

Scene 9 — 40:57

“MICR” is the abbreviation for “Magnetic Ink Character Recognition”. (In the movie, you hear it pronounced “mik-ker”, but you can also say “mike-r”.)

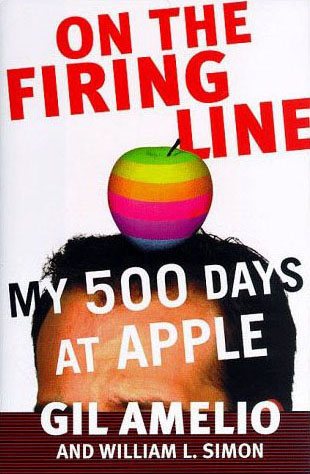

Magnetic recognition — now largely replaced by optical recogntion, with the exception of check reading — was needed because optical scanning wasn’t possible in the 60s! No CCDs — the heart of a scanner! — existed before their invention in 1973 by amongst others Gil Amelio, who later became CEO of National Semiconductor (now acquired by Texas Instruments) and Apple (before the second coming of Steve Jobs).

As technologies go, magnetic reading is highly limited but it is also extremely fast, which is why it’s still used for check reading. Says Abagnale: “These checks whisk through a high-speed bank check sorter at a rate of two thousand items per minute, or forty checks per second. When the checks go down the sorter trails, they’re traveling at a speed in excess of four hundred miles per hour! The machines could do it more quickly, but the checks would catch on fire.” (book “The Art of the Steal”, page 45)

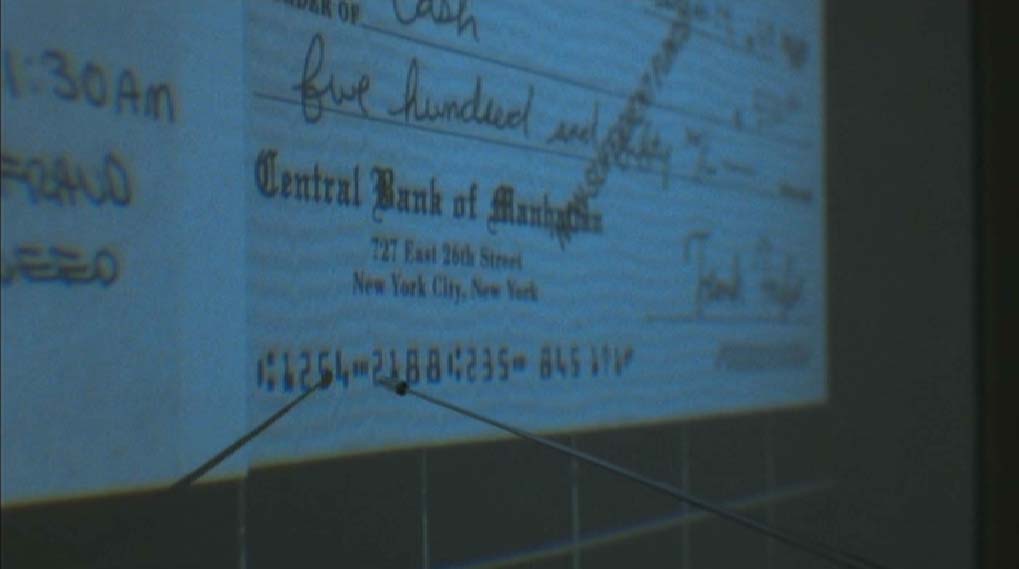

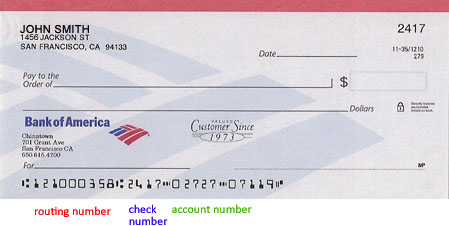

MICR printers like these add the amount to the codeline. The other data — identification of the bank, the client’s account number, the check’s serial number — was preprinted. The bank teller (played by Elizabeth Banks) tells us that the MICR printer “uses special ink to encode the account numbers at the bottom of the checks.” (scene 9, 40:31). More about magnetic ink later!

Scene 9 — 40:36

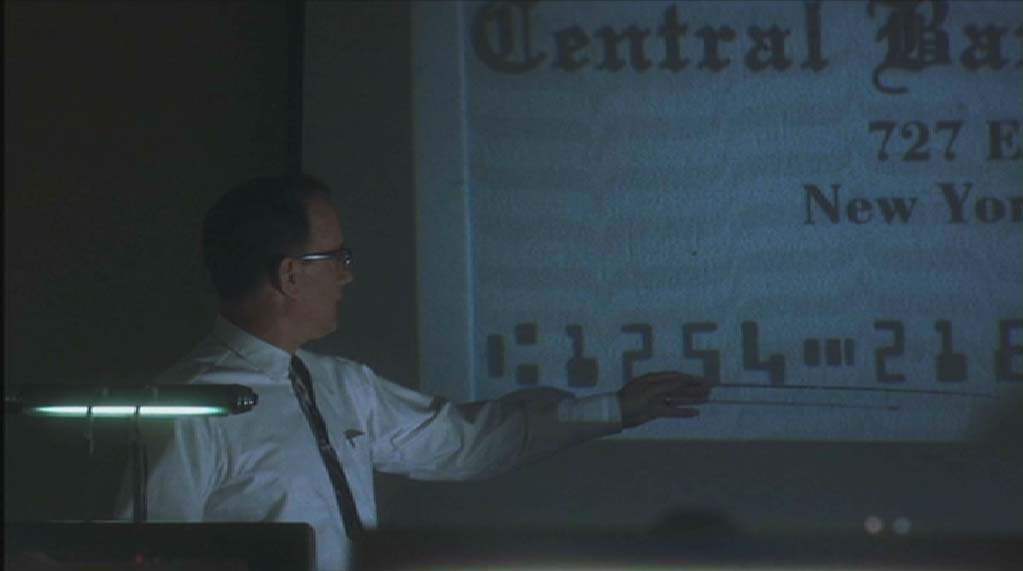

Abagnale was the first forger to manipulate the routing numbers on checks, and hence the inventor of “the float”. Hanratty explains to his F.B.I. colleagues how “codelines” — when the checks are scanned optically, we call them “optical lines” — and routing of checks works.

Before we explain in detail what

“the float” is, we need to

make a comment about film

technique: in this scene,

Spielberg makes extensive use of

backlighting

(from two sources — the adjoining

office space through the Venetian blinds

and the Kodak slide projector)! With

backlighting,

the main source of light is behind the

subject, directed towards the

camera and the subject is silhouetted.

That’s a style characteristic of

Spielberg — watch the night

scenes in

“Close Encounters of the Third Kind”

(1977), for instance. (Or think of the

use of flashlights in

“E.T.”...)

IMDB page on Close Encounters of the Third Kind

—

Wikipedia page on Close Encounters of the Third Kind

But perhaps the most famous

backlighting

scene in film history is

the assault on the tramp by the

“droogs”

in

Stanley Kubrick’s

movie “A Clockwork Orange” (1971)…

IMDB page on A Clockwork Orange

—

Wikipedia page on A Clockwork Orange

(Also notice the use of headlights in scene 16 (1:34:54-1:35:00). They illuminate the hallway of the Strongs’ family home to announce the arrival by car of the F.B.I. agents. This is purely done for effect. It certainly isn’t realistic: the drive in front of the house is packed with the guests of the engagement party, so the car couldn’t approach the porch like that without running over most of them...)

Spielberg’s director of photography Janusz Kaminski could backlight this scene because Hanratty makes use of a Kodak Carousel — a great product from the 60s that Kodak continued to manufacture until the end of 2004 — to project slides. No PowerPoint presentations in those days!

And here’s another interesting fact: episode 13 of season 1 (“The Wheel”) of the great TV series “Mad Men” (2007), the series about an advertising agency on Madison Avenue in the 60s, is dedicated to the Kodak Carousel. In it, you see creative director Don Draper going for the jugular when he pitches his marketing idea to the Kodak executives. “There’s the rare occasion when the public can be engaged on a level beyond flash. [...] Nostalgia [is] delicate but potent.”

… And he wants to chuck their product

name — “the wheel”

— altogether! “This

device isn’t a spaceship,

it’s a time machine. It goes

backwards, forwards. It takes us to a

place where we ache to go again.

It’s not called ‘the

wheel’, it’s called

‘the carousel’. It lets us

travel the way a child travels: round

and round, and back home again, to a

place where we know we are

loved.”

IMDB page on Mad Men

—

Wikipedia page on Mad Men

The account executive that brought the client in leaves the room in tears…

On to “the float”! Abagnale explains the scam in detail in his book “The Art of the Steal” (on page 41-43): “Forgers live on the theory that stall creates float and float equals profit.” (The title of this section in the book is “How Buying Time Buys You Money”.)

(As this is a crucial piece of information — remember the word “OCR” in the title of the web site — I’ll quote longer passages from Abagnale’s books for once, but it’s crucial that you understand this fraud mechanism well. I still consider this “fair use” of source material…)

Every good forger alters the numbers along the bottom of the check. Inside a set of brackets is a nine-digit number. That’s the bank’s routing number, and it’s like a ZIP code. When you cash the check, that number allows the check to be sent back to the bank where your account is. The first two digits of that number signify the Federal Reserve Bank in your jurisdiction. For example, New York would be 02. There are twelve Federal Reserve banks scattered around the country; like a dozen eggs, there are a dozen banks. The numbers are assigned from east to west: for instance, 01 is Boston, 03 is Philadelphia, 08 is St. Louis, and 11 is Dallas.

Scene 9 — 41:17

Let’s say that you have a company check from a bank in New York and the company is in New York. You can color-copy fifty of them. That’s quite simple. But if you start cashing them today at supermarkets in the New York area, by tomorrow the bank knows about it and the company will complain that these are forged checks. They call the police, and they send out a bulletin that you’re out there passing bad checks. How many places do you get to in a day? Ten? If you got on the New Jersey Turnpike with all its traffic, you wouldn’t get to the next exit.

But what if I drop the “0” and replace it with a “1”? When I cash the check, the clerk at the courtesy booth at the supermarket will look at the name of the bank and recognize that it’s a New York bank, so it’s a local check and he has no problem cashing it. But when the store deposits the check, by changing that number, just as if I had altered a ZIP code, I force that check to go all the way across the country to Hawaii to clear. When it gets to Hawaii, someone notices that the routing number is incorrect and puts a white strip called a “Lundy strip” across the bottom of the check over the old routing number and sends it back. But by the time that happens, two weeks will have passed. So I have fourteen days instead of one day to wander all over New York cashing bad checks. Forgers live on the theory that stall creates float and float equals profit.

(A “Lundy strip” or “repair strip” is the white adhesive label that a bank affixes to the bottom of a check to correct errors in the codeline.)

Scene 9 — 42:15

“Float” is a financial term. It refers to the duplicate money present in the banking system during the time between a deposit being made in the recipient’s account and the money’s deduction from the sender’s account. Simply put, the float is the time between the negotiation of a check and its clearance at the bank of the check-writer.

Float is very obvious in the use of checks because of the time delay between a check being written and the funds to cover that check getting deducted from the check-writer’s account. Once the recipient of a check — the “payee” — deposits it in his account, his bank credits, increases his account immediately, assuming that the payer’s bank will ultimately transfer the funds to cover the check. Until the payer’s bank actually sends these funds, the payer and payee have the same money in their accounts. Once the payee’s bank notifies the payer’s bank (by presenting the checks), the duplicate funds are deducted from the check-writer’s account and the check is considered to have “cleared” the bank.

The second track of John Williams’ movie score is called “The Float”!

John Williams

“Catch Me If You Can”

Polydor, 2003

ISAN B00007BKUE

Here’s the comprehensive list of the 12 current Federal Reserve Districts. (As Abagnale explains, the Federal Reserve comprises 12 regional Federal Reserve Banks.)

| Federal Reserve Districts | |||

| 01 | Boston | 07 | Chicago |

| 02 | New York | 08 | St. Louis |

| 03 | Philadelphia | 09 | Minneapolis |

| 04 | Cleveland | 10 | Kansas City |

| 05 | Richmond | 11 | Dallas |

| 06 | Atlanta | 12 | San Francisco |

(These districts were established in 1914, as the Federal Reserve System itself! Allowing the Federal Reserve to act as nation-wide check-clearing center shortened the clearing time — until then, often several weeks! — and reduced the excessive exchange rates for checks.)

Government checks have the routing number “000000518”.

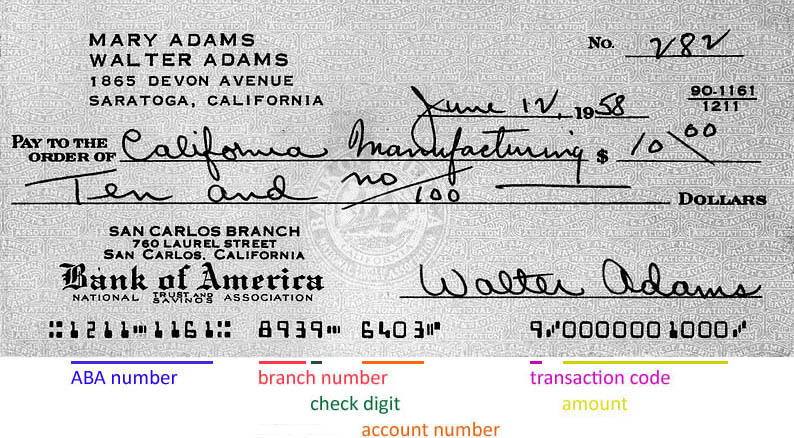

There’s the general principle. Let’s take the same, well, “route” again step by step! We’ll use the book “Catch Me If You Can” (page 93) this time. “Below the bank legend, across the bottom left-hand corner of the check, I laid down a series of numbers with magnetic tape. The numbers purportedly represented the Federal Reserve District of which Chase Manhattan was a member, the bank’s FRD identification number and Pan Am’s account number. Such numbers are very important to anyone cashing a check and tenfold as important to a hot-check swindler. A good paperhanger [slang word for check forger] is essentially operating a numbers game and if he doesn’t know the right ones he’s going to end up with an entirely different set stenciled across the front and back of a state-issued shirt.”

We have more info on pages 101-102: “I said earlier that the good check swindler is really operating a numbers game. All checks, whether personal or business, have a series of numbers in the lower left-hand corners, just above the bottoms. Take a personal check that has the numbers 1130 0119 546 085 across the bottom left-hand corner. During my reign as a rip-off champion, not one out of a hundred tellers or private cashiers paid any attention to such numerals, and I’m convinced that only a handful of the people handling checks knew what the series of numbers signified. I’ll decode it.”

The number 11 denotes that the check was printed within the Eleventh Federal Reserve District. There are twelve and only twelve Federal Reserve Districts in the United States. The Eleventh includes Texas, where this check was printed. The 3 after the 11 tells one that the check was printed in Houston specifically, for the Third District Office of the FRD is located in that city. The 0 indicates that immediate credit is available on the check. In the middle series of numbers, the 0 identifies the clearing house (Houston) and the 119 is the bank’s identification number within the district. The 546 085 is the account number assigned the customer by the bank.

How does that knowledge benefit a check counterfeiter? With a bundle in his swag and a running head start, that’s how. Say such a man presents a payroll check to a teller or cashier for payment. It is a finelooking check, issued by a large and reputable Houston firm, payable at Houston bank, or so it states on the face of the chit. The series of numbers in the lower left hand corner, however, starts with the number 2, but the teller or cashier doesn’t notice that, or if (s)he does, (s)he is ignorant of the meaning of the numbers.

Scene 9 — 41:45

A computer isn’t. When the check lands in the clearing-house bank, usually the same night, a computer will kick it out, because, while the face of the check says it’s payable in Houston, the numbers say it’s payable in San Francisco and bank computers read only numbers. The check, therefore, is sorted into a batch of checks going to the Twelfth District, San Francisco in this instance, for collection. In San Francisco another computer will reject the check because the bank identification number doesn’t jibe, and at that point the check lands in the hands of a clearing-house bank clerk. In most instances, the clerk will note only the face of the check, see that it is payable at a Houston bank and hand-mail it back, attributing its arrival in San Francisco to computer error. In any event, five to seven days have passed before the person who cashed the check is aware (s)he has been swindled, and the paperhanger has long since hooked ’em.

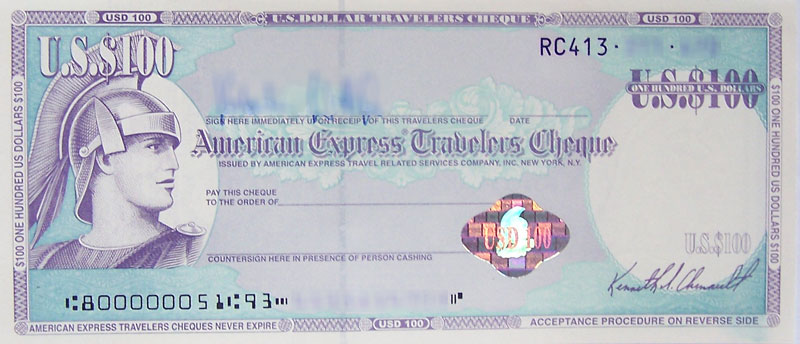

“The Art of the Steal” discusses a scam that’s specific for traveler’s checks (on page 77): “The first thing to know is that all traveler’s checks begin with the routing number 8000. Forgers who forge traveler’s checks go to a great deal of trouble and expense to engrave them. In order to make their money back, they need a lot of time to pass them. To give themselves this time, they will remove the 8000 code and insert the check code of a bank located a far distance from where the checks are being cashed. This will give them just enough time to float those checks so they can cash them.”

Guess what? New legislation has made “the float” easier today than in the old days! This extra info is mentioned in one of Abagnale’s white papers (“Check Fraud and Identify Theft — Volume III” (2004)): “There’s a ‘Federal Reserve Regulation CC’ (from 1992) that reduced the time a bank can hold deposited funds as uncollected items. To give bank customers quicker access to their funds, local checks must be paid within 2 days, non-local checks within 5 days — even if the actual check has not been paid. For instance, if the bank discovers only 10 days later that a check is fake, they’re stuck — the money’s already on the customer’s account. If a bank wants to return a bad check, they have to be much quicker nowadays. And the forgers are well aware that the window available to them has expanded. Manipulating the codeline to the max, they now have extra days to exploit the float!”

Furthermore, any account that has been open for 30 days may no longer be considered a new account — where extended “hold” periods on depoisited funds apply. If you’re a forger, you’d be tempted to open a checking account and wait for a month before you start making use of.

And then there’s a piece of legislation called the “Expedited Funds Availability Act” (“EFAA”). It established another time window that allows a different fraud mechanism called “check kiting”. A check drawn on bank A is deposited in bank B without proper funds to cover the check. Bank B grants the depositor a conditional credit: the depositor can now write checks against these uncollected funds! The depositor goes back to bank A and writes a check drawn on bank B to cover the original check. This game can go on for quite a while… With check kiting, the float is used to delay the notice of non-existing funds.

Check kiting is not illustrated in the movie, it’s just mentioned in passing by Carl Hanratty. When he’s standing a phone boot to inform his colleagues that the Skywayman is actually a kid, he adds this comment: “[...] don’t forget the airports, he’s been kiting checks all over the country.” (scene 12, 1:04:57)

Scene 12 — 1:05:01

In the book “Catch Me If You Can” (on page 112), Abagnale discusses an extra scam where he made $42,000 dollar by having bank tellers simply slipping money deposit slips of other customers into a machine that stamps — and reads — them.

In the lower left-hand comer of the deposit slip was a rectangular box for the depositor’s account number. I never filled in the box, for I knew it wasn’t required. When a teller put a deposit slip in the small machine in his or her cage, in order to furnish you with a stamped receipt, the machine was programmed to read the account number first. If the number was there, the amount of the deposit was automatically credited to the account holder. But if the number wasn’t there, the account could still be credited using the name and address, so the number wasn’t necessary.

There was a fellow beside me filling out a deposit slip. I noticed he neglected to give his account number. I dawdled in the bank for nearly an hour and watched those who came in to deposit cash, checks or creditcard vouchers. Not one in twenty, if that many, used the space provided for his or her account number.

Surreptitiously I pocketed a sheaf of the deposit slips, returned to my apartment and, using press-on numerals matching the typeface on the bank forms, filled in the blank on each slip with my own account number. The following morning, I returned to the bank and just as stealthily put the sheaf of deposit slips back in a slot atop a stack of others.

You find this scam slightly transformed in the published screenplay (on page 78), but not in the movie! It’s called “the switch”.

(Abagnale later bought a Burroughs 1000 magnetic encoder to add his account number to deposit slips.)

This is only possible because U.S. bank branches are open offices. It’s just desks in a big surface occupied by bank tellers. How are you going to steal forms and put them back in a European bank branch?

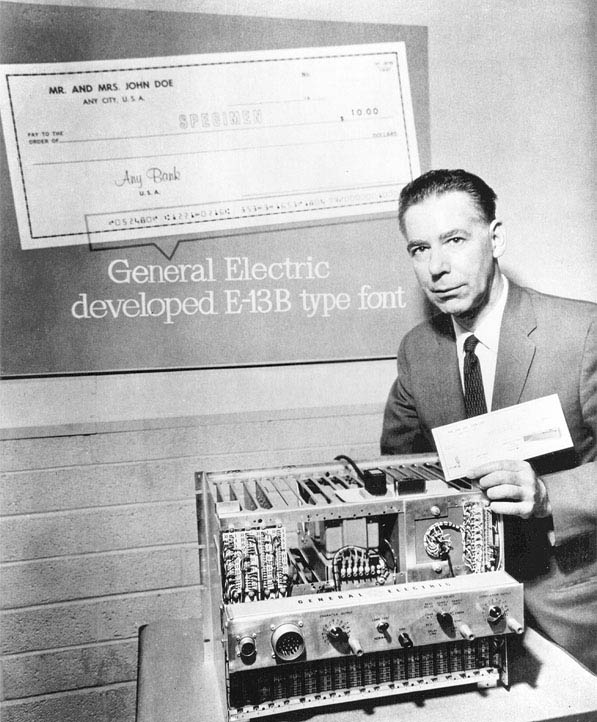

Back to check and deposit slip reading. Believe it or not, but the very first MICR system was presented at the 1961 annual sales meeting of General Electric’s Computer Department by the G.E. spokesman (from 1954 onwards) and later U.S. president Ronald Reagan.

His speech starts like this: “Hello. I’m Ronald Reagan speaking for General Electric. At General Electric, you know, progress is our most important product. But, all progress must have a starting point. All great human enterprises begin at a frontier. The pioneering of hostile lands… the mushrooming of the Atomic Age with its mixed blessing of destruction and construction… the rolling back of space frontiers beyond the planets to the stars… and the beginning of the information-handling revolution. All these had a common starting point — a frontier of progress.”

You can download the full speech, but that’s enough for now! Simple words spoken by a simple man? Definitely! But you can with equal measure read these few lines of empty but inflated chatter as the summary of his entire presidency. Ronnie never got further than mouthing copy written by others — whether he was dealing with the chimp Bonzo, General Electric or the country…

Ronald Reagan’s speech “Frontiers of Progress” for the ’61 General Electric Sales Meeting (PDF file, 87 KB)

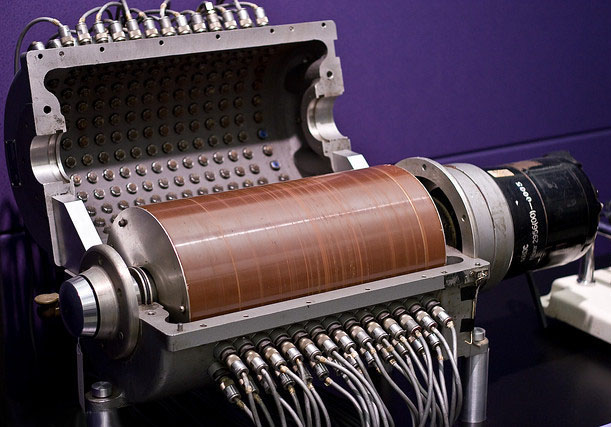

True or false? The first computer ever built in the Silicon Valley was an OCR — well, MICR — machine. True! We’re talking about the year 1955. The only machine that had been built on the West Coast so far was the prototype JOHNNIAC, the counterpart of ENIAC. Meet ERMA. No, not Irma, ERMA, short for “Electronic Recording Machine - Accounting”!

The objective of ERMA was simple enough: the Bank of America wanted to spearhead the automation of the record-keeping process. At that time, all banks closed by two p.m., simply so that in the afternoon the staff could update their clients’ accounts manually after the financial transactions of the morning… You probably won’t believe me, but back then bank accounts were kept alphabetically. To check the identity of an account holder, the clerks had to compare the signature on each check with the client’s signature on a card. Was that check written by B. Smith from University Avenue, Berkeley or B. Smith from Hollis Street, Emeryville? Only the signature could tell! It was ERMA that introduced the concept of bank account numbers.

Processing checks and storing the account data electronically would change that dynamic drastically. Fair enough. Except that none of the technology existed! Computers? Barely existed in 1950, they certainly couldn’t handle accounting. Transistors were beginning to become available but were still totally unreliable, one used vacuum tubes instead. (Jack Kilby built the first working integrated circuit (“chip”) with some 10 transistors in 1958; Intel marketed its first commercial microprocessor, the Intel 4004 in 1971!) Any storage media? Magnetic drums and nothing else.

So, it all had to be built from scratch! In 1950, the Bank of America asked the Stanford Research Institute (“SRI”) first to design such a banking system, then to build an actual prototype — the bank’s traditional equipment suppliers wouldn’t go there! (SRI’s Douglas Engelbart invented the computer mouse in 1964. Eight years later, the research institute completed Shakey, the first general-purpose mobile robot controlled by A.I.)

The ERMA prototype was completed in 1955. By then, the development had cost about $10 million!

The machine contained 8,200 vacuum tubes, 34,000 diodes, over a million feet (300,000 m.) of wiring and weighed 25 tons! It contained a check sorter (processing 10 checks per second), a high-speed printer (printing 10 to 15 lines per second), two magnetic drums for memory and 12 magnetic tape drives. The computer was spread across four rooms, required a staff of 5 operators and consumed 80 kW of electricity — that’s a whopping 80,000 Watt!

The prototype processed 33,000 accounts in one hour and was used around the clock to update 5.5 million accounts per week — doing the work of 500 clerks. The first system was installed in 1959. By 1966, the bank’s ERMA systems procssed 750 million checks per year! How’s that for kickstarting electronic banking? Another benefit is that processing checks rapidly reduces the duplicate money in the financial system — the “float” — substantially!

The bank did not fire its clerical workers. They became bank tellers and the local branches stayed open on afternoons, years ahead of the other banks. The Bank of America, in 1950 the largest bank of California, became the largest bank in the world by 1970.

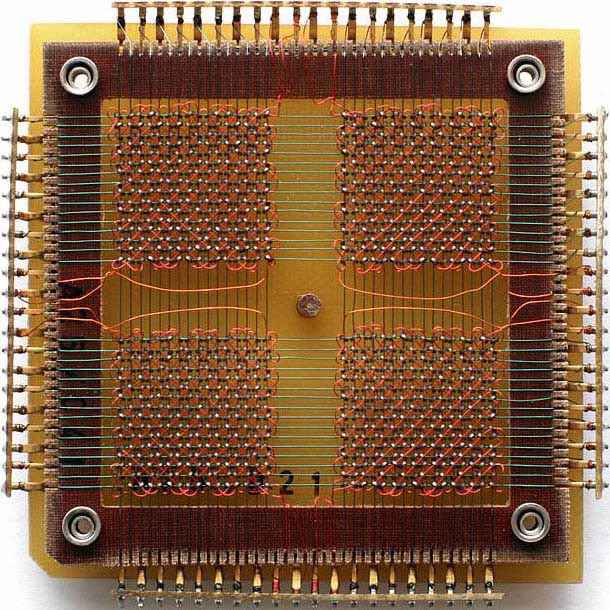

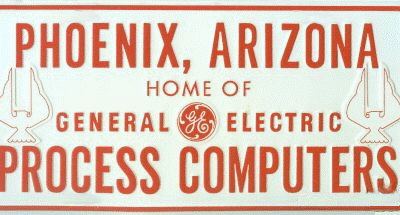

True or false? The largest commercial computer order placed up to 1960 was for an OCR system. True! Once the SRI had developed the prototype, General Electric received the $30 million order to build 32 operational ERMA machines (named the “GE-100”). That’s right, 32 full ERMA systems. (To think that Thomas Watson, the president of I.B.M., is famously reported to have said in 1943: “I think there’s a world market for maybe 5 computers.”!)

General Electric replaced the vacuum tubes by transistors and used a 4 KB magnetic-core memory — the technological progress of the last years allowed them to do that.

This was the largest commercial order because the U.S. government, specifically the Department of Defense (“DOD”), financed some military computer programs, mainly for the nuclear capability. One of these programs was DARPA, whose ARPANET would later become the Internet. Then senator and later vice-president Al Gore promoted legislation that expanded ARPANET (the “Gore Bill”). The broader, public-access initiative kickstarted the Internet. Incidentally, the first ever computer virus was researcher Bob Thomas’ self-replicating worm “The Creeper” in the year 1971. It was harmless enough: infected computers on ARPANET displayed the message “IM THE CREEPER, CATCH ME IF YOU CAN!” to stunned users.

To fulfill the order, General Electric, a company that was not yet active in computer projects, built a new manufacturing plant, the “Deer Valley Plant” in Phoenix, Arizona, having occupied rented facilities closeby on the Peoria Avenue first.

One of the key electronics engineers to work at the Phoenix plant was… Arnold Spielberg, father of Steven! He became head of the section “Process Control Engineering” in 1957. He developed a 20-bit computer and some process control devices for the department and he was one of the G.E. employees to attend the 1961 sales meeting hosted by Ronald Reagan. In 2006, Arnold Spielberg was fêted for his contribution as “Computer Pioneer” by the “Institute of Electrical and Electronics Engineers” (“IEEE”).

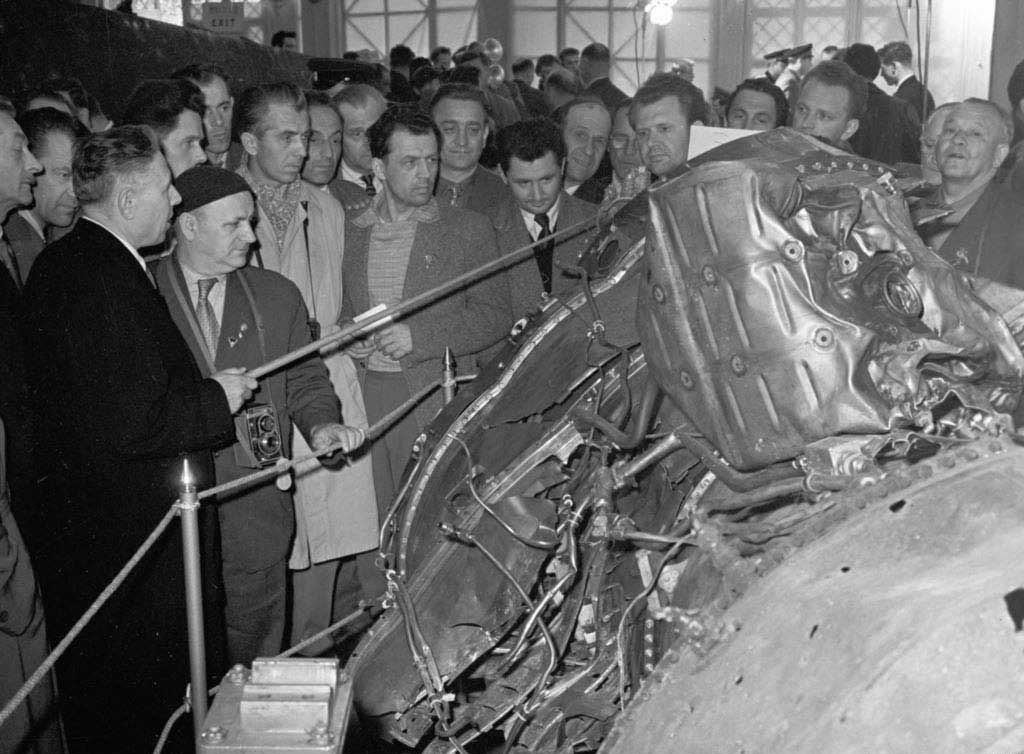

(As G.E. employee, Arnold participated in a brief engineer exchange program with the U.S.S.R. in the middle of the Cold War! Five Americans went to Moscow, five Russians came to Arizona for a few weeks. Arnold, whose parents were born in Russia, spoke Russian and volunteered immediately. Luck has it that he arrived in Moscow in the beginning of 1960, a few weeks after C.I.A. pilot Francis Gary Powers was shot down in his U-2 spy plane.

This

1960 U-2 incident

is the subject of Spielberg’s

spy thriller

“Bridge of Spies” (2015).

IMDB page on Bridge of Spies

—

Wikipedia page on Bridge of Spies

The Soviets put the salvaged wreckage of the U-2 plane, Powers’ space suit and helmet on public display in Moscow as a trophy. Arnold Spielberg was able to visit with his colleagues and took some Kodachrome photographs home to his 13-year old, fascinated son.)

Let me add this in closing: as is often the case, the General Electric managers in Arizona acted as mavericks. When they submitted their offer to manufacture the computer systems to the Bank of America, G.E. corporate headquarters did not know about it. The “Computer Department” they pretended to represent did not (yet) exist; they “electronified [the department] into action”, is how Ronald put it in his speech. On several occasions, the company president and CEO Ralph Cordiner sternly warned them that G.E. would “under no circumstance [...] go into the business machine business”.

In Spielberg’s latest movie

“The Fabelmans”

(2022), the semi-autobiographical

coming-of-age drama

that gives the basics on his

father’s career in electronics,

Arnold Spielberg is also cautioned in

no uncertain terms: “Ralph

Cordiner is going to skin you

alive.”

IMDB page on The Fabelmans

—

Wikipedia page on The Fabelmans

A justified threat when when you know that he developed the GE-200 series of 20-bit “general-purpose” computers in Phoenix with Chuck Propster, already a colleague of his when he created the BIZMAC for RCA in New Jersey. (That gigantic computer which occupied 20,000 square feet (1,900 square meter) had a unique feature: it used hundreds of permanently mounted tape drives. The tape data could be accessed immediately – no need to mount and dismounting individual tapes!)

The 200 series with the GE-225 as main model allowed students and researchers at the Dartmouth College to develop the programming language BASIC. However, it did not comprise the incompatible GE-210, the direct spin-off of ERMA sold to other 14 banks than the Bank of America…

Banking automation or general computing, the engineers pulled it all off and General Electric acquired genuine expertise in computing… after which “the suits” messed it up big time. In 1970, I.B.M.’s dominant position in computing was stronger than ever and G.E. sold its computer department to Honeywell, one of the other seven dwarfs competing against the “Big Blue”, for $200 million. Will the bureaucrats ever learn?

Arnold Spielberg and many others saw the writing on the wall when G.E. replaced the department manager by an incompetent accountant with an oppressive management style. In September 1963, Arnold left to join I.B.M. in San Jose. And so Steven Spielberg would spend the rest of his youth in California, closer to the Hollywood film industry…

As for I.B.M., well, they dominated the market for check readers towards the end of the 60s. See the Big Blue logo on the left-most storage unit with the check sorter on the right side? No more frontiers of progress for good old G.E.!

(Here’s a check reader/sorter of today getting shown off. The basics are still the same, the machines just look more modern – and they apply image scanning alongside magnetic reading…)

Demonstration of check reader/sorter

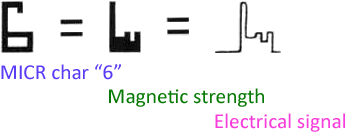

Magnetic ink was chosen to print the account data on the check — doing so made the checks both human- and machine-readable: the ink makes the data legible to the bank teller, the metallic particles in the ink can be interpreted with magnetic readers.

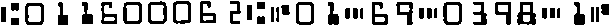

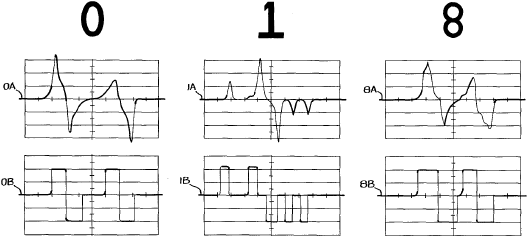

Sending each character past a magnetic reading head produces a distinct, unmistakable electrical waveform. (With the first version of the MICR font, the routing or transit symbol sometimes got mistaken for an “8”. This character was redesigned in the final version E13B.) Data is limited to the front side of the check — running the check through the MICR printer and the check sorter once suffices, a crucial factor in the system’s processing speed.

But I’m sure you’ve already been wondering what these quirky symbols mean that get used alongside the digits. And what is this “transit” symbol? I don’t want to push this very far, because the “control characters” are boring, purely technical stuff, but let me give you a quick idea.

| E13B Character Set | ||

| ||

| 0 - 9 | digits | |

| transit or routing symbol |

marks the beginning and end of the

transit or routing number

(that identifies the FDR district, bank and bank branch) |

|

| amount symbol |

marks the beginning and end of the

amount

the amount is added with a MICR printer the other data are preprinted on the check |

|

| “on us” symbol |

indicates the start of a free field

with the bank’s internal data

tells the check reader that the next few numbers identify the bank branch, account number and check number |

|

| separator or dash symbol |

can be used as separator character

inside the “on us” field

can separate the bank branch number from the account number |

|

Boring? Told you so! And the font’s name is undoubtedly equally cryptic to you: the “E” in “E13B” indicates that this was the 5th font considered for this application, E being the 5th letter in the alphabet. The “13” indicates that the height, width and width of the strokes of each character are either 0.013” (0.33 mm.) or a multiple of that size. The final letter indicates that the 2nd revision of the banking font was used — B is the 2nd letter of the alphabet. Let’s just say that the engineers who worked on the project had no marketing sense. None!

The G.E. management on the other hand didn’t hesitate to take credit and beat the drum — must have picked that up from Ronnie, would be my guess! Let’s be very clear about one thing: General Electric did not invent or develop the MICR font, SRI did.

SRI employee Kenneth Eldredge, a Dr. in physics — that’s him in the picture posing as a General Electric employee —, was assigned U.S. patent 3,000,000 for his pioneering work on MICR. And that was no coincidence: the U.S. Patent and Trademark Office (“U.S. P.T.O.”) kept the round number for an important invention and this work — a milestone in the arrival of the information age — fit the bill! Deservedly so, the ERMA project was a rare occasion where typography, technology and economy intersected…

Kenneth Eldredge’s U.S. patent 3,000,000 for Automatic Reading System (PDF file, 956 KB)

The American Bankers Association (“ABA”) adopted the E13B font as industry standard for the codeline. To this day — some 60 years later! — it’s still in use in the United States, Canada, Great Britain and Australia.

Opening titles — Abagnale — Hanratty — Checks — Stationery — Pay checks — Pilot — Typewriter — Hotel — M.D. — Lawyer — Printing — Arrest — Prison — G-man — Sitemap — Search